The average American consumer might not think much of their access to financial services. But for consumers that are underbanked or unbanked, the very high costs of relying on alternative financial solutions, such as payday loans, check cashing services, money orders, and pawnshop loans can be astronomical and create a vicious cycle of financial pain that many will likely never escape from.

According to a report conducted by the U.S. Federal Reserve, an eye-opening 22% of American adults were found to be underbanked or unbanked. This means 63 million Americans either have no bank accounts whatsoever or may have some sort of account with a banking institution yet are still heavily reliant on alternative financial services.

While the report found evidence of underbanked and unbanked consumers across all income levels, the overwhelming majority of these consumers were in the lower income bracket. These consumers were also identified as having less education or being racial or ethnic minorities, according to the Fed report.

However, there is some good news for unbanked and underbanked consumers. The rise of financial technology, or fintech, has vastly expanded digital financial services that can help bridge the gap and allow these consumers to ditch payday loans and other predatory financial products.

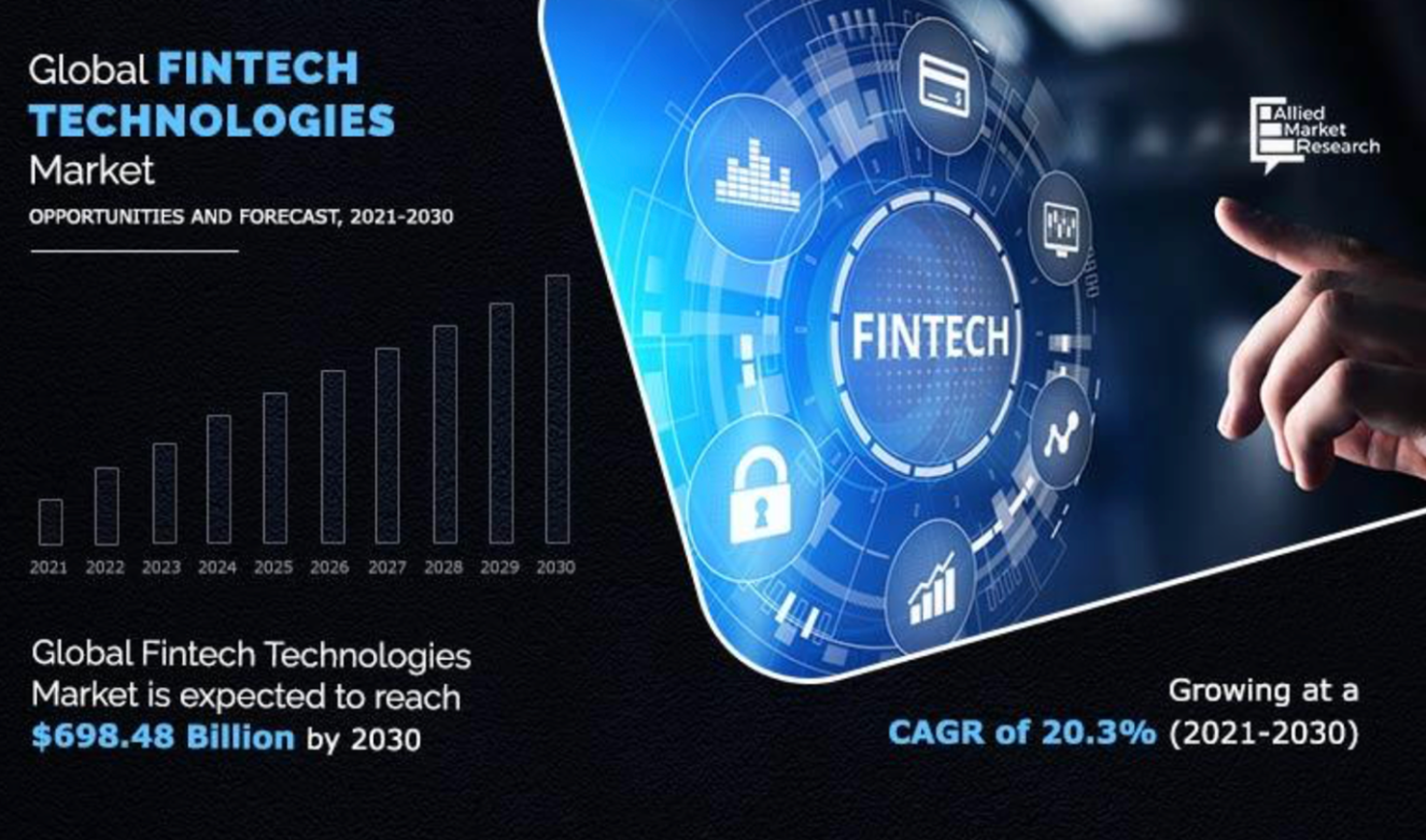

According to Allied Market Research, the global fintech market was valued at $110.57 billion in 2020 and is forecast to reach $698.48 billion by 2030. This represents a compound annual growth rate (CAGR) of 20.3% between now and 2030.

Source: Allied Market Research 1

The OLB Group OLB + Free Alerts and Cuentas CUEN are two fintech companies that just recently announced a strategic partnership to help expand quality fintech services to the underbanked and unbanked communities.

Breaking Down the Strengths & Key Assets of OLB Group and Cuentas That Will Be Leveraged in Their Partnership

Utilizing their respective strengths and focuses within the vast world of fintech, OLB and Cuentas serve as a solid complement to each other’s business plans. OLB’s omnichannel payment processing platform, combined with Cuentas’s expertise in digital financial services and established relationships with major financial firms, provides a unique opportunity to help millions of American consumers gain access to fintech solutions that may not be readily available to them otherwise.

OLB Group:

OLB is an integrated financial technology and payment processing service provider that primarily serves small-to-mid-sized merchants in the United States. The fintech company’s Omnisoft platform provides cloud-based commerce solutions, which can be used for transactions that occur online, in-store, or on a mobile device.

OLB’s Omnisoft platform is an established solution that maintains over 10,500 active merchants across all 50 states. In 2021, those merchants completed over 28.5 million transactions with a total gross value of around $1.36 billion.

Outside of its Omnisoft platform, OLB’s Evance subsidiary (https://evanceprocessing.com/) will play a major role in the partnership with Cuentas. Evance is a payment processing solution that allows merchants to accept payments from tablet-based point-of-sale systems, mobile payments from services like Apple Pay, and more.

In total, OLB maintains a robust portfolio of subsidiaries that cover payment gateway solutions, equity crowdfunding, short-term loans, cryptocurrency payment solutions, and more.

Source: OLB Presentation 1

Cuentas:

Cuentas provides digital finance and e-commerce solutions primarily to the underbanked and unbanked Hispanic, Latino, and immigrant populations. The company’s offerings include prepaid debit cards, ACH & mobile deposits, cash remittance services, peer-to-peer money transfers, and more.

The Cuentas General Purpose Reloadable (GPR) card features a digital wallet integration, as well as discounts and rewards for making purchases at major brick-and-mortar stores and online retailers. Furthermore, Cuentas is an official partner with VanillaDirect Load, which allows Cuentas customers to reload their GPR cards at a network of over 50,000 retailers across the U.S., such as Walgreens, CVS, Walmart, 7-Eleven, and more.

Using the Cuentas App, consumers can obtain access to discounted Western Union WU +0.07% + Free Alerts money transfer services, discounted gift cards to retailers & gaming subscriptions (Xbox, PlayStation, etc.), reward points from purchases and international long-distance calls, and more.

Source: Cuentas Presentation 1

In June 2022, Cuentas completed the acquisition of a 19.99% stake in Cuentas SDI, LLC, the owner of SDI Black011 assets. SDI is a leading provider in the prepaid portal and digital financial services space, which maintains a robust nationwide retail distribution network of over 32,000 bodegas and convenience stores across the United States. In 2021, SDI produced revenues exceeding $8.2 million from its vast retailer network.

OLB & Cuentas: The Partnership Structure

On August 22, 2022, OLB and Cuentas officially entered into a software licensing and transaction sharing agreement, where both fintech companies will establish a merchant services relationship to reach bodegas and convenience stores throughout the United States. Under the agreement, OLB will sell or rent their point-of-sale devices to merchants within Cuentas’s SDI network of 32,000 bodegas. Cuentas will look to incorporate and leverage its reloadable debit card solution on OLB’s POS platform.

Cuentas will be tasked with marketing the OLB-branded products platform as a white-label app for payment processing and debit cards. OLB will look to develop Cuentas’s mobile application and associated products as an Application Programming Interface (API). This means Cuentas will have access to databases and services to allow its app users to register, obtain approval and complete the onboarding process to gain access to the Cuentas GPR, mobile app, and mobile wallet.

“We’re thrilled to finally say that Cuentas has achieved, under contract, the ability to diversify its products under Cuentas.com which serves the current Mobile App, available in Android and IOS. Cuentas.net will serve the mobile payments segment. Cuentas Mobile will serve the mobility customers that will be able to enable their cell phone services under the Cuentas family of products to become their financial services provider,” stated Arik Maimon, Cuentas Co-Founder and Interim CEO.

OLB and Cuentas have agreed on a 50/50 profit-sharing split on all net revenues generated from its partnership. On the OLB side, net revenues will be generated from the sale or rental of POS devices to Cuentas SDI merchants, services, and products from Cuentas’s white label platform, GPR reload fees, and more.

Cuentas’s shared net revenues will come from reload purchases made through the OLB POS devices across its SDI network, retail digital products sold through an OLB POS device, mobile activities, and more.

Source: StreetEasy 1

The partnership is believed to be potentially lucrative for both companies. OLB estimates the partnership will generate an annual revenue run-rate between $8 million and $10 million once the joint services officially launch sometime in December 2022 and into Q1 2023.

Ronny Yakov, CEO of OLB Group, said, “We at OLB Group see the opportunity to expand our merchant services base in a market that we currently don’t have a footprint in, and also provide existing products and services to those bodegas and convenience stores as an additional stream for revenues besides the 10,500 merchants that we currently service.”

OLB Already Having a Record-Revenue Producing Year Thus Far Into 2022

OLB has reported tremendous growth in topline and bottom-line financial results through the first six months of 2022. Through the end of June 2022, OLB generated total revenues of $17,158,849 with an EBITDA of $602,643 and an adjusted EBITDA (adjusted for stock compensation) of $745,169.

Compared to the results for the same period in 2021, total revenues surged 239.11% y/y, EBITDA jumped 145.17% y/y and adjusted EBITDA results showed year-over-year growth of 163.11%. Here is the full breakdown of OLB’s financial results for both six-month periods:

Aside from topline and bottom-line results, OLB has no corporate debt, holds a cash position of $3.6 million, and reports strong insider ownership of 32%, as of the end of Q2 2022. In addition, 98% of OLB’s revenue is generated from its profitable e-commerce businesses, which management estimates will continue to grow over the coming quarters.

The first half of 2022 financial results gives OLB an annualized revenue run rate of $36 million, compared to only $9.6 million ARR for 2021. That represents a massive growth of 275% in ARR for 2022 compared to 2021. In the end, OLB management estimates total revenue from 2022 to come in a range between $36 million and $38 million.

Considering the expected annual revenue run rate enhancement of $8 million-$10 million from the Cuentas partnership, coupled with the company’s expectation of $35 Million in revenue in 2022 (vs. 2021 revenue of $16.71 million), OLB’s year-over-year revenue comparisons could be significant—attracting more investor interest.

Overall, the OLB and Cuentas partnership is a major opportunity for both companies. The vast bodega footprint across the United States represents a prime opportunity for the partnership to upgrade these local merchants into formidable financial centers for unbanked and underbanked consumers. Furthermore, the current framework being developed by OLB and Cuentas is highly scalable and can be deployed into other markets to serve unbanked and underbanked communities around the world.